The Roofing M&A Webinar: Everything You Need to Know in 60 Mins

The complete primer on selling your roofing company—from valuation basics to deal structure to life after closing. Watch our 60-minute masterclass with live Q&A from 20+ roofing owners who asked the exact questions you're thinking but didn't know how to ask.

The Knowledge Gap That Costs Millions

If you're a roofing company owner thinking about an exit, you probably have more questions than answers.

What's my company actually worth?

How do these deals work?

What happens to my employees?

How much will I pay in taxes?

What does life look like after I sell?

This comprehensive masterclass answers every question you didn't even know to ask. Despite being in the hottest acquisitions market in the history of the roofing industry, most roofing owners approach M&A completely blind:

No baseline knowledge of how deals really work

Unrealistic expectations about valuations and timing

Poor preparation that leaves money on the table

Wrong advisors who don't understand the roofing industry

The results? Suboptimal outcomes in the biggest financial transaction of their lives.

This masterclass eliminates the knowledge gap. After watching this webinar, you'll understand the entire process before you need to navigate it.

Knowledge advantage = negotiation advantage = better outcomes.

What You'll Learn:

Roofing Company Valuation Fundamentals

EBITDA vs revenue focus, industry multiples, and why some $10M companies sell for more than $15M companies.

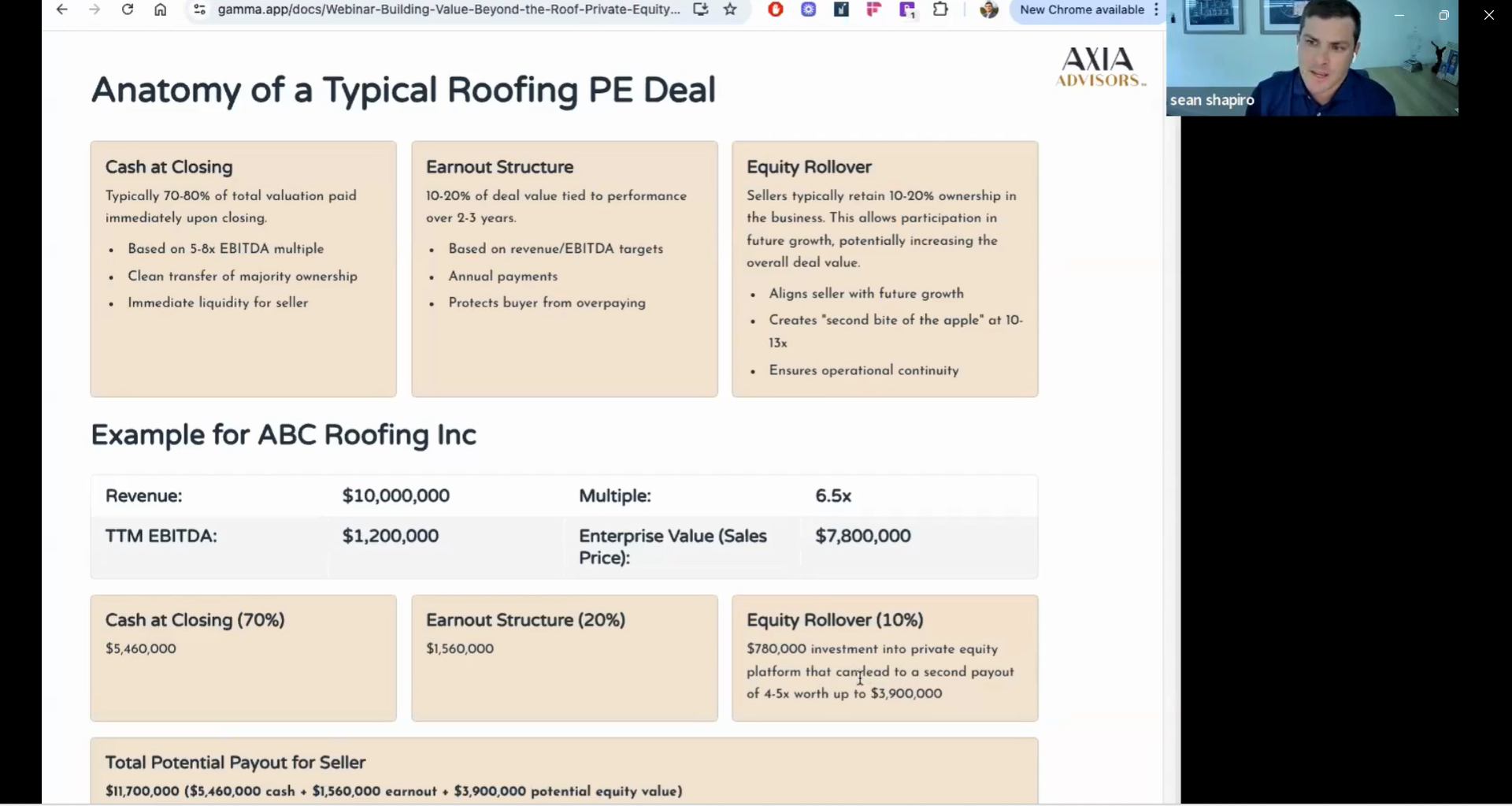

Complete Deal Structure Breakdown

The 3-bucket system every transaction uses: cash at closing, earnouts, and rollover equity explained in detail.

The Private Equity Buyer Landscape

Who's actively buying roofing companies, what they're looking for, and how to position yourself as their ideal platform or tuck-in target.

Critical Financial Thresholds and Metrics

Why $1M EBITDA is the magic number for serious buyers and what happens if you're above or below it.

Documentation That Commands Premium Multiples

Systems and processes that add $500K+ to your valuation vs. owner-dependent operations that kill deals.

Tax Strategy and Transaction Costs

Capital gains treatment, investment banking fees, legal costs, and the real math on what you'll net at closing.

Life After the Sale: What Actually Happens

Employment agreements, earnout tracking, non-compete reality, and what your day-to-day looks like post-acquisition.

Testimonials

"Thanks so much for coming on. This is probably the best explanation I've heard yet of PE money buying out companies. Really broke it down, and I appreciate that!"

Kevin Barrelle

Owner of Barrelle Roofing

"Epic call today. Epic call! That was a really phenomenal explanation of the key concepts there. So thank you very much, Sean"

Mike Coday

Roofing Sales Coach

"Can't thank you enough for explaining the whole industry and sharing your knowledge with us. I feel much more prepared and educated now."

Jeremy Stevens

Summit Roofing & Exteriors

Your Instructor: Sean Shapiro

Sean doesn't just teach roofing M&A - he's lived it.

Built Reliant Roofing from startup to $25M revenue and 125 employees.

Navigated his own exit to private equity in 2021.

Experienced post-acquisition life working for the buyers

Founded Axia Advisors to help other roofing owners get better outcomes.

Completed multiple transactions representing roofing contractors.

The difference? You're learning from someone who sat in your seat and successfully navigated what you're considering.

Ready to Understand What Your Exit Could Look Like?

No cost. No pitch. Just straight-up valuable insights about your biggest financial transaction.

Total value: 60 minutes that could be worth millions in your exit.

Stop guessing about valuations, deal structures, and market timing. This masterclass gives you the real-world perspective from someone who's been exactly where you are.